A Hero with an Idea Whose Time Has Come

Venture investing is the synthesis of Rick Rubin and Thomas Carlyle

Early-stage venture investing is the synthesis of Thomas Carlyle and Rick Rubin: founder + tailwind. You need a great person, but it also must be an idea whose time has come.

Rick Rubin writes:

“If you have an idea you’re excited about and you don’t bring it to life, it’s not uncommon for the idea to find its voice through another maker. This isn’t because the other artist stole your idea, but because the idea’s time has come.”

Going from zero to one is hard enough. Venture-scale startup creation usually drafts off significant tailwinds. These tailwinds can be technological paradigm shifts, regulatory or capital markets changes, or societal/cultural upheaval.

The current startup moment has two powerful tailwinds:

1) The explosive arrival of large language models in the wake of ChatGPT.

2) A rebolstering and interest in hardware startups. Many point to the success of Anduril or the Ukraine and Israel conflicts as reasons for this, but I think the most important change has been a societal/cultural one as founders and investors brashly declare themselves pro-America, pro-reshoring, and pro-technology.

A thousand flowers are blooming.

“Art arrives in movements.” Both of these tailwinds have created their own movements: the AI startups headquartered in the Bay Area and the large warehouses of El Segundo housing their hardtech startups. The temptation for many investors, especially those who tend to be indefinite optimists, is to look to ride the tailwind indiscriminately. Their LPs will ask them to get “exposure” to these trends as if startups were an asset class. They will invest with an index mindset, spraying and praying that somewhere in their array of “bets,” one will pan out to be a power-law fund-returner.

Yet, it is not merely enough to identify the tailwind. Venture capitalists must also get the individual company right.

Kareem Zaki of Thrive put it well in an interview nearly two years ago:

“One of the things that's challenging about venture is, I think you have to have macro conviction, what's this big tailwind that I'm going to invest behind, but then actually have micro precision in the individual company. You could have been in the 90s and say ecommerce is going to be a really big deal, but if you didn't invest in Amazon or eBay, you didn't really participate in that trend in a meaningful way.”

A rising tide does not lift all boats, especially if you want to deliver outlier exceptional returns. If anything, you’re more likely to deliver subpar returns in these categories due to the price being bid up around the spaces that everyone is looking to deploy in. I believe most investors deploying in AI and hardtech startups are going to deliver bad returns, paying high prices for mediocre or zero outcomes. Picking gets even harder when a bubble forms and both cynical grifter and genuine hero run into the same pool. Some of the smarter investors I know have retreated entirely from both spaces, choosing to focus on areas where there is less competition and only genuine builders remain. It’s worth remembering that the most iconic startups are one-offs who break the mold, often outside of the spaces that are currently hot.

However, seismic shifts are not easy to ignore and there are sometimes true multi-decade tailwinds that emerge that you must invest in. Previous examples include the PC revolution (Microsoft), dotcom (Amazon, Google), mobile (Uber, Instagram, DoorDash), and cloud (Snowflake).

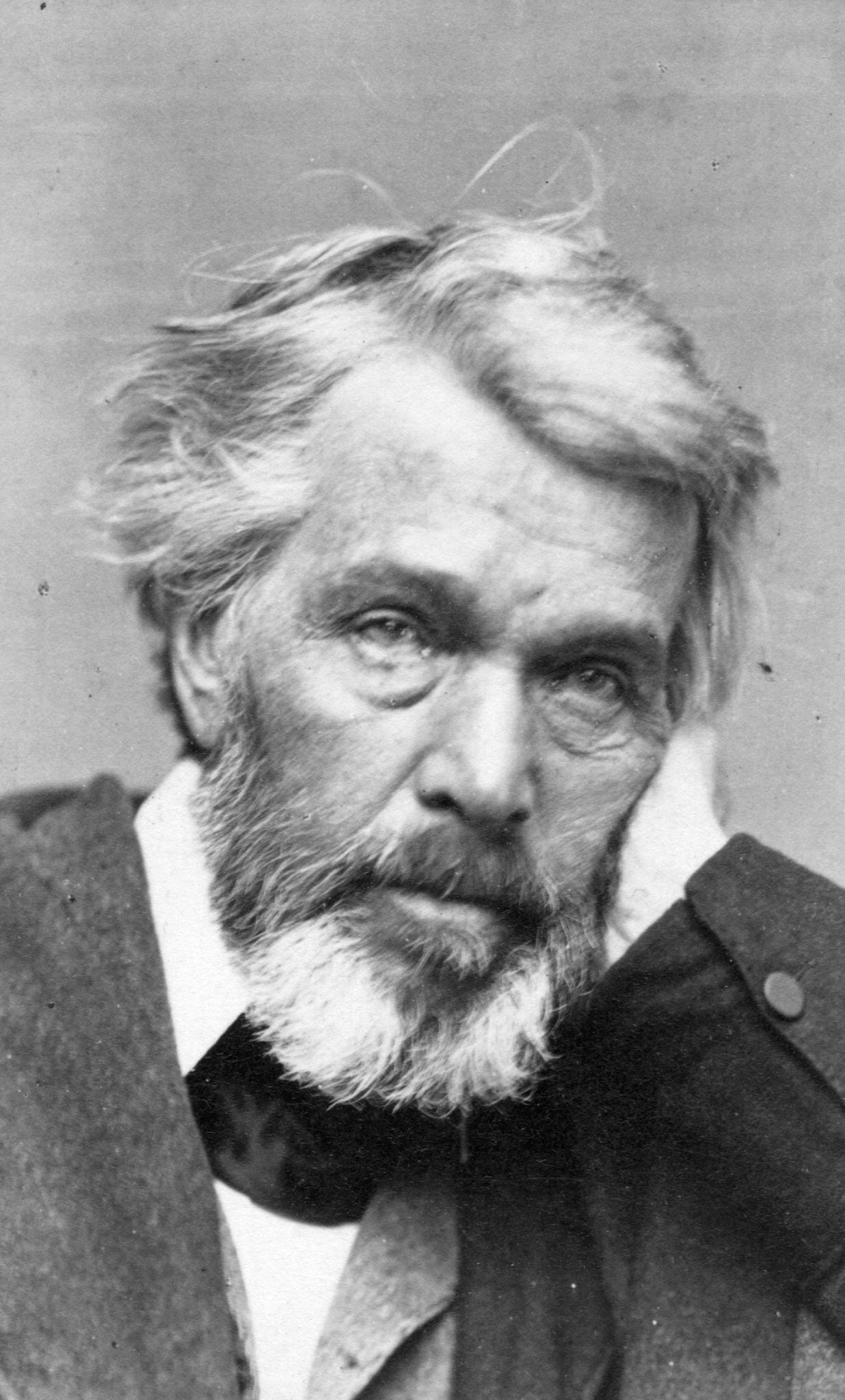

This is where Carlyle comes in. Carlyle is much maligned in modern historiography because the “great man theory of history” seems archaic in today’s hyper-egalitarian world. We want to believe that anybody is capable of greatness and that we’re all equal in terms of talent. Yet whenever an investor declares they invest based on “founder strength” or “strength of the team,” they declare themselves believers in Carlyle’s theory: great individuals are the ones who remake the world.

Carlyle’s lectures go through six traits of heroes that illustrate some of the archetypes of great founders:

Hero as divine

Hero as prophet

Hero as poet

Hero as priest

Hero as man of letters

Hero as king

Hero as divine

The central characteristic Carlyle identifies here is bravery. Odin was the leader of the Norsemen and inspired them with his courage: so brave that it inspired worship and his eventual ascension to Godhood. Very few founders can possibly inspire that level of worship and cult of personality, but there are a few obvious current ones.

Notable ‘divine’ founders: Elon Musk, Palmer Luckey

Hero as prophet

Carlyle’s prophet is someone who comes up with a new idea and then spreads it, inspiring men and women to follow his “God-inspired” word. The chief identifying characteristic is one of sincerity and fervency.

“Zero to One” is the modern-day Bible of many a startup founder, Thiel its prophet. For another flavor of founder, Paul Graham and his essays form the basis for their inspiration. Each has dozens or hundreds of acolytes, building startups in the style of their prophet.

Notable prophet founders: Peter Thiel, Paul Graham, Oprah Winfrey

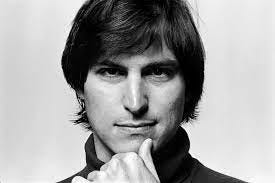

Hero as poet

Has there ever been a more poetic startup founder than Steve Jobs? A poet penetrates ‘the sacred mystery of the Universe” and glimpses its beauty. The “beautiful includes the good” according to Goethe: the poet’s passionate intensity shapes and creates works of art that live beyond their time. Poetry is eternal and timeless. Greece has been largely inconsequential on the world’s stage for centuries, yet the works of Homer will be read for the rest of time. Even when Apple is usurped as the biggest technological company in the world, Jobs will inspire founders with his creativity, passion, and original thinking.

Notable poet founders: Steve Jobs, Estee Lauder, Edwin Land, Enzo Ferrari

Hero as priest

For Carlyle, this is a “prophet shorn of his more awful splendor, burning with mild equable radiance as the enlightener of daily life.” By nature, prophets and priests are idol-breakers: they destroy the previously worshipped false gods of the past to bring in the new. One of the primary uniting characteristics of all heroes is they are sincere. The priest is both sincere and practical, a “captain under a spiritual King…interpreting in a more familiar manner to men.”

Notable priest founders: Sam Altman, Alex Karp, John D. Rockefeller, Bill Gates

Hero as man of letters

The printing of books changed the nature of hero-worship as leaders could influence far and wide simply through the written word. Carlyle identifies this as a change where a new belief began that a “person of intellect” should be at the top of affairs, even potentially leading governments. Satoshi’s whitepaper might be the best example of this in the modern technology world: a nine-page manuscript that altered the nature of finance forever.

Notable ‘man of letters’ founders: Satoshi Nakamoto, Patrick Collison, Jeff Bezos

Hero as king

This is perhaps the most universal amongst founders: a person who brings order to chaos, even though they may present as a revolutionary. They are sincere with a desire to rule their domain because of a singular perspective on the way to make things right in the world. Every great founder is a monarch in their company, the central leader and source from whom everything flows. Delegation is crucial, but the best founders still micro-manage certain areas, while steering the ship and setting the vision.

Notable ‘king’ founders: Mark Zuckerberg, Henry Ford, Larry Ellison, Brunello Cucinelli

Many heroes (and founders) span multiple archetypes. But I’d be hard-pressed to find a great founder who did not have at least one of these qualities.

Traditionally, the Rick Rubin view of the act of creation is at odds with Carlyle’s. If it’s an idea whose ‘time has come,’ the theory goes that we overrate the great men and women of history by giving them too much credit. However, I believe the correct synthesis is not ‘either/or’ but ‘both/and.’ The idea may be sitting out there in the ether, waiting to be discovered, or amalgamated from current knowledge, but it still takes a great person to make the discovery or act of creation.

Venture investing sits at this intersection: to rewind all the way back to Kareem’s comment, you have to get both the macro and the micro right. It’s the only way to deliver exceptional returns and be a part of the story that changes the world.

If you’re a founder, reach out at pratyush [at] susaventures [dot] com. Carlyle’s lectures can be found here. Thanks to Lucas Vaz from Ravelin Capital for reading earlier versions of this article.