This is a cross-post of something I published on the Susa Medium.

Despite the hype and massive deployment of capital, many of the commonly cited use cases for crypto — particularly those attached to the ‘web3’ moniker last fall — are fairly implausible to us. However, the prospect of non-custodial, permissionless finance and digital assets remains extremely interesting. With that in mind, we have begun digging into the DeFi landscape and investing through both our Susa and Humba vehicles. Here are some our early POVs and areas of interest.

Overview

A common expectation of web2 investors crossing into web3 and specific chain “maximalists” is that there will eventually be 1–3 smart contract platforms to “rule them all.” Network effects, the “Lindy effect,” and developer adoption will take over with the superior technology winning out while other chains die.

While plausible, our current opinion is that there will continue to be a proliferation of chains: Layer-1s (L1s), Layer-2s (L2s), and ‘sovereign chains,’ creating a multi-chain future. From a first-principles perspective, a blockchain is simply a ledger of who owns what and, at least thus far, the temptation to reset that ledger and start fresh as the new early adopters has proved attractive to investors, founders, and community members.

The main counterargument to grapple with here is: “How much value is there in provenance?” For example, in NFTs, nearly all value has accrued to Ethereum-based NFTs. Will that continue to be the case in the future or is that simply because NFTs are on their first “real” cycle of adoption? In a few years, will Solana NFTs also have their own meaningful level of history that attracts investors? Similarly, in the next cycle, will Solana and other L1s also accrue a meaningful monetary premium and developer adoption as Ethereum has? If not, can they capture value in some other way?

Nevertheless, our current baseline prediction is a multi-chain future built on existing L1s, more L2s with their own coins, and a lot of new chains that haven’t been launched yet.1 Applications will sometimes live directly on top of these smart contract platforms or have their own independent sovereign chains (advantages of sovereign chains are discussed here).2 We just saw dydx leave Ethereum to build a sovereign chain using the Cosmos SDK. Even a project that started as an NFT discussed building its own L1.

We will certainly be wrong if we end up in a sustained bear market of several years (5+). In that scenario, we expect the remaining developer adoption and investment activity to stabilize primarily on the most trusted platform: Ethereum. Even in that scenario, when crypto comes roaring back, it’s likely that Ethereum will have too much of a lead for new L1s to overcome.

The hyper-financialized nature of crypto will always invite speculation as part of the bootstrapping mechanism — even for projects that want to eventually move into real-world utility. The most difficult part for projects, including those that attract meaningful amounts of activity, are tokenomics that create value accrual long-term without becoming securities. A multi-chain future does not automatically mean each part of the stack will capture value by the same order of magnitude.

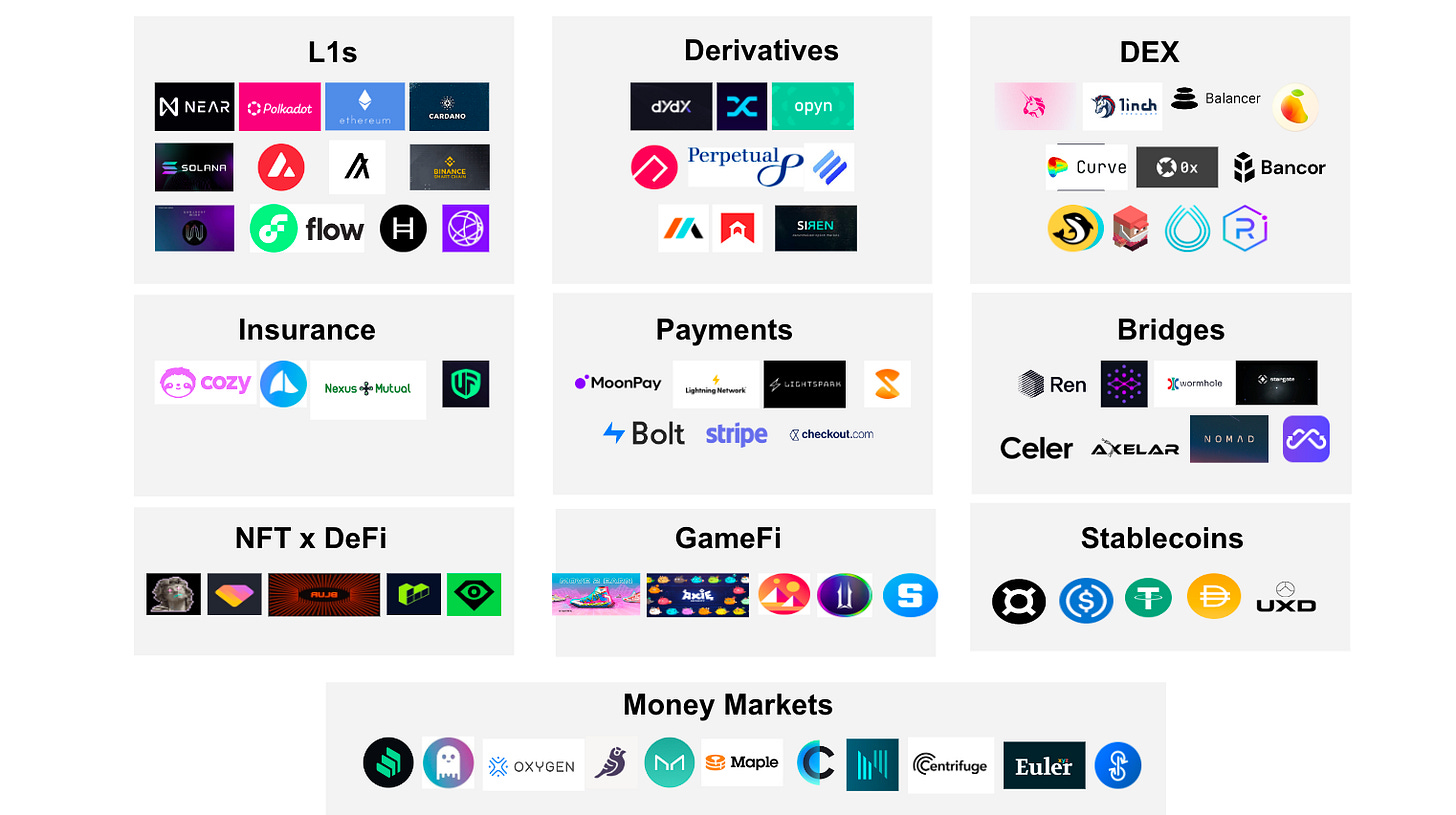

Within DeFi itself, the most interesting areas of value creation to us currently are the following:

Exchanges

Insurance

Money Markets

Bridges

GameFi

NFT x DeFi

Two areas we’re not particularly interested in currently are stablecoins and payments. We think, by and large, stablecoins are winner-take-all with network effects. Overcoming USDC’s lead is difficult without borderline Ponzi and questionable and game-theoretically untested mechanics. There are some interesting experiments like Frax and Beanstalk (relaunching with a V2 after a governance attack), but we’re just monitoring them at this point.

Payment rails for stablecoins and other crypto “could” be interesting, but we consider those more fintech than crypto. Unlike most crypto opportunities, payments require a different lens like understanding the specter of large web2 players like Stripe. We’re open-minded to looking at companies like this, but classify this differently than most DeFi opportunities.

Decentralized Exchanges

Uniswap is currently dominant amongst Ethereum-based DEXes. Even though liquidity tends to be path-dependent, there are signs that volume can move away with the right incentives or change in structure. Sushiswap was famously able to vampire attack Uniswap and take away up to 70% within a week. Uniswap was able to retaliate by launching its own token, a new version of the protocol, and Sushi eventually fell apart due to its lack of internal direction (current thinking around DAO governance has a lot of problems despite the long-term potential).

As a point of comparison, among centralized exchanges, Bitmex, Coinbase, and Binance ruled the roost in 2018, with the latter two the most popular amongst retail investors while Bitmex dominated for institutionals. FTX was able to come along in 2019 and out-execute Bitmex and is now valued higher than Coinbase in private markets.

While difficult, it could still be early enough in the DEX space that competitors to Uniswap are viable on Ethereum. One example, Crocswap, is building a single-contract DEX, a meaningful departure from current DEX architecture. Single-contract DEXes like Crocswap are interesting because they reduce the high gas costs, significant tax burdens, low market quality for sophisticated traders, and the fragmented liquidity across protocol versions of legacy DEXes.

Aggregators and cross-chain DEXes could also be unique opportunities here. Additionally, if you accept the multi-chain thesis, that means there could be opportunities to invest in exchanges on new or existing L1s (eg: TraderJoe on Avalanche, Serum on Solana, etc.)3 as they launch. Derivative exchanges (Perpetual, Opyn, etc.) are also interesting, but remain quite difficult to build successfully. In TradFi, derivative markets dwarf spot markets.

In general, exchanges have been the application with the biggest winners in crypto so far and may continue to be a ripe opportunity for investment.

Insurance

Smart contract hacks, stolen keys, and outright Ponzi collapses are rife in crypto. This is probably the area with the most surprising amount of whitespace despite the acute pain point. We suspect this is mainly due to the difficulty of underwriting risk. Nexus Mutual is the largest player in the space, but it’s very early days. Cozy and Risk Harbor may be two compelling companies to look at and we are actively on the lookout for the right entrepreneur who wants to go after this problem. One idea could be insurance for NFTs, perhaps with BAYC users as the initial target market. Binary options with an easy UX as insurance coverage could also be interesting.

Money Markets

There are a lot of players here across many types of products, but perhaps the largest unsolved problem is undercollateralized lending/borrowing that does not double as a Ponzi scheme. This is a staple of traditional finance that has so far been difficult to replicate within crypto. Maple Finance and Clearpool Finance are two early players here, but we should expect more experiments to be run over the next few years. Vitalik’s recent paper illustrating a mechanic for the creation and adoption of ‘soulbound tokens’ would unlock the capability for the equivalent of an on-chain credit score.

Decentralized prime brokerages could also be an interesting area of opportunity, particularly as functioning on-chain derivative markets spin up. Oxygen on Solana was one experiment with early promise, but may be collapsing due to its tokenomics.

Bridges

Bridges are critical to a “multi-chain” future, but there’s a lot of competition here and differentiation is difficult. LayerZero launched to much fanfare last year and we’re fans of Synapse and look forward to monitoring this space as it grows larger. An open question we have is whether the bridge layer of the stack can capture value in a meaningful way or is at risk of commoditization.

NFT x DeFi

Despite OpenSea’s early lead, there remain companies attempting to build an NFT marketplace for ‘professional traders’ (Blur, seed led by Paradigm) or a more decentralized competitor (LooksRare). SudoSwap is a marketplace that allows users to swap fungible ERC-20s for ERC-721 NFTs or even semi-fungible tokens (ERC-1155).

NFTs are the crypto primitive that has most crossed the chasm to non-cryptonatives. While exchanges remain a viable potential investment if there’s the right team and insight, the most interesting opportunities may remain in financialization or collateralization of NFTs (Fractional) or integrating with the real world at large (Claim). This combo is likely going to do the best during bull markets or times of heavy retail interest.

GameFi

Play-to-earn games took the world by storm last year with the popularity of Axie and StepN. A skeptic would say these are largely Ponzi games whose collapse often comes just as quickly as their rise. A more charitable view is that play-to-earn unlocks a new gamer archetype: the ‘speculator gamer’ or ‘worker gamer.’ That view is laid out more clearly in that tweet, but the main takeaway is that if they’re successful, play-to-earn games won’t replicate frameworks from traditional gaming and will instead be their own new thing with a focus around economy design.

“If I can play a game, and have an equivalent amount of fun, and also make money — well, obviously I’d rather do that, right?”

-Arianna Simpson, Andreessen Horowitz

Financialization changes the very nature of a thing itself and contrary to Arianna’s quote above, we don’t believe that most gamers look at the prospect of $ in gaming as an altogether good thing. Most gamers have different motivations for gaming and once financial incentives are introduced, it can easily supersede everything else whether you like it or not. A skin or asset within a game becoming a potential “investment” rather than a “thing you buy with no expectation of return” has a deep psychological impact on how you view it. I don’t think crypto investors have fully grappled with how that affects the game dynamics. As a former professional poker player, I can attest that the psychological impact of playing a game for money, even one that is skill-based, is quite a bit different than paying for assets within one.

Our current view is that opportunities for crypto gaming are interesting if/when they are two-fold: A) well-designed economic games where crypto makes the game ‘better’ than a counterpart but everyone is aware of the financial reason for playing it OR B) games/studios/projects that use crypto as a funding mechanism for development, but the game itself is divorced from crypto or financialization.

The Future

Crypto is a rapidly evolving space where the most interesting breakouts rarely fit into such neat categories. Market maps are, by their very nature, often backward-looking. New opportunities could lie in financial products built around blockspace cashflow, the much ballyhooed and long-promised tokenization of real-world assets, financializing city creation via tokens and community, startups built around soulbound tokens as a primitive, or other products that I’m not aware of but a special founder will come and create a product for. We must remain open-minded and aware that innovation happens at the edge. It requires close conversations with builders to skate where the puck is going rather than where it has been.

Thanks to Leo Polovets and the rest of the Susa team for feedback. If you’re building in the space and want to reach out to us, e-mail pratyush@susaventures.com.

Additionally, if you have feedback on any part of this article, even if it’s to tell us we’re completely wrong, email that same address. We’ll happily take advantage of Cunningham’s Law.

As I was writing this last month for our team, I clicked over to Twitter and saw that Neal Stephenson (originator of the ‘Metaverse’ term) has launched a new L1.

So far, we haven’t seen many applications launch their sovereign chains. In part, I believe this is because the currently easiest way to do this (Cosmos) has lower developer adoption than Ethereum or Solana. Additionally, a sovereign chain requires thinking around tokenomics and chain-level security: some application developers may prefer to punt that to the future, making it easier to build on top of a chain with built-in security like Ethereum. On the flip side, a sovereign chain with a need for security immediately creates a clear value accrual mechanism for your token rather than more speculative concepts like governance.

A point of caution is that these are somewhat contingent bets. Not only are you betting on the exchange itself, but you’re also betting that the underlying chain will attract meaningful long-term activity.