The most contrarian bet in venture capital right now is Thrive’s investment in OpenAI at an $80B valuation.

Before you bring your pitchforks against me or wonder if I’ve gone crazy, let me explain.

You can be contrarian in two ways:1

Having a different POV than the mainstream

Having 100% conviction in the mainstream POV and doubling down on it in a way that seems overly aggressive or delusional to them

Thrive’s investment fits both, the former to most VCs and the latter to the general public.

When the news broke last week that Thrive was purchasing shares from OpenAI employees at an $80B valuation, the reaction from many was skepticism that the lofty numbers could be justified or that there was meaningful room for upside from here, barring selling to a greater fool. However more important than any private or public skepticism have been the actions of VCs over the past year since the ChatGPT moment.

Hundreds of millions, if not billions, of dollars have been poured into competing foundation model companies. Many, including myself, have proclaimed the future will be built on an open-source ecosystem. While every VC is aware of the threat from OpenAI and will rigorously prosecute every startup under an “incumbent vs startup” framework, most have developed their AI investing thesis agreeing with most, if not all, of the following ideas:

Oligopoly, not monopoly: Base case, there will be an oligopoly of highly-valued foundation model providers.2 Bull case: there will also be a healthy open-source model ecosystem that is competitive with the best foundation models.

An open-source, flexible ecosystem wins over a closed-source system: Many AI infrastructure investments are predicated on a thriving open-source ecosystem, or at the very least, the foundation model providers not providing great infrastructure and tooling to interact with them seamlessly.

OpenAI wrappers are not interesting companies: Building your own models or having access to proprietary datasets is a key part of differentiation and value delivery.

“Domain expert” models will emerge that are better than the foundation models: Companies will build specialized, fine-tuned models that can deliver higher-quality performance and efficiency across specific domains than the foundation models.

I’m not privy to Thrive Capital’s internal conversations or modeling around the OpenAI investment, but you can get a lens for their frameworks in growth from this quote from Josh Kushner in a recent Invest Like The Best podcast:

“At the later stages, I always say to her [my mom] that we invest in Fifth Avenue, and my view is you always pay a fair price for Fifth Avenue.

Markets go up, markets go down, but at the end of the day, if you invest in quality, that quality will ultimately compound on itself. There's a scarcity value to quality. Those that invested in Fifth Avenue a decade ago are happy that they have it today.

The biggest mistakes that we've made as a firm are when we've way overpaid for Fifth Avenue or we've bought Third Avenue thinking that it would become Fifth Avenue, and that's just never the case. Our view is if you are concentrated in the most exceptional businesses and you hold those businesses over a very long time, a lot of the value in those sectors that you're investing in will ultimately accrue to the #1 player.

There are a lot of firms that actually have a very different point of view, which is they like to invest in the second or the third player in an industry. Our view is we want to partner with the most visionary founders that are building the category-defining assets in their sectors and partner with them over very long periods of time because the value will ultimately compound on itself.”

-Josh Kushner

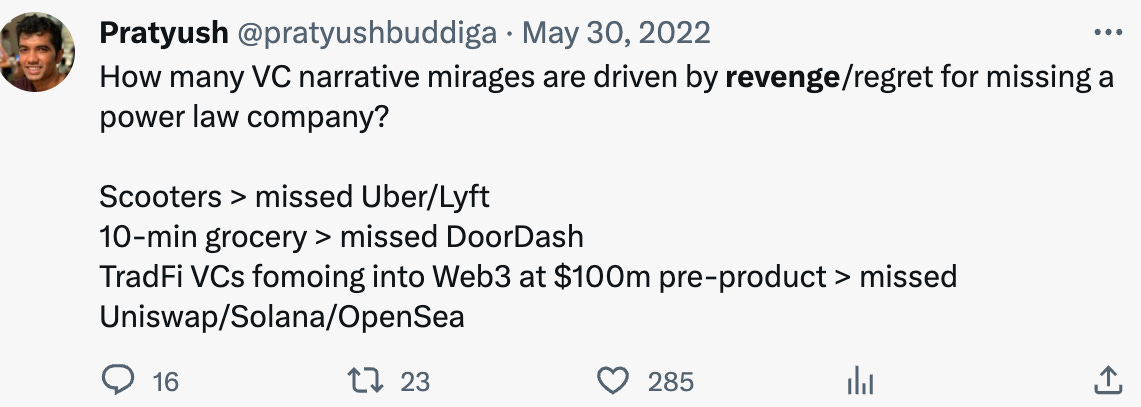

History is littered with examples of copycat and revenge investments made by VCs trying to catch up to a winner where the competition is already over or trying to invent a new category to ameliorate a previous mistake.

Most VCs completely missed OpenAI and were spending 2020-2022 (even after the release of GPT-3!) talking about monkey jpegs or that the future of work was remote. When ChatGPT happened, everyone immediately pivoted into AI and lo and behold, there were infinite opportunities for new infrastructure investments and new foundation model providers that would “easily” catch up to OpenAI. Open-source models were seemingly released that showed little performance tradeoff. Many companies raised money for applications that would compete directly with ChatGPT across various axes like personal assistant, advisor, information-gatherer, friend, therapist, etc.

But what if Kushner is right and OpenAI is Fifth Avenue, while everything else is Third Avenue?

Let’s go back through the previous tenets many VCs tend to hold onto and think through this possible alternate world:

Monopoly, not oligopoly: Unlike cloud compute, foundation models are not commodities.3 Quality will instead compound on itself and there will be a winner-take-most dynamic where the majority of the returns, if not usage, will accrue to OpenAI. If Anthropic is only 99% as good as OpenAI, they won’t get 1% less market share, but a fraction of it.

A well-designed, closed-source system will capture more value than an open-source flexible system: Companies and customers will always choose to use (or more importantly, only pay a premium for) the highest-quality, best-integrated, and best-designed system. Apple crushed Android in terms of market value capture: 50% of revenue and 82% of operating profit despite only 21% of total shipments. OpenAI will similarly dominate. I’ve heard VCs talk about AI having a “Linux” moment earlier this year, but it’s important to remember there was a never a massive company built commercializing Linux, nor did it ever get above 3% market share.4 OpenAI will build the necessary platform and infrastructure tooling around itself to obviate the need to partner with anybody but them.

OpenAI “wrappers” will be the most successful companies in their space: Rather than trying to innovate and then failing on the difficult task of building the highest-performant and efficient models, OpenAI wrappers are laser-focused on distribution, the product built around the models, and developing moats outside model performance (eg: switching costs, network effects, brand, etc.)

New OpenAI models will always be the highest performant and efficient across the majority of domains: Even if there’s a period where a new “expert” model shortly surpasses OpenAI in some domain, it’ll fall behind once again upon the latest release. Even proprietary data is harder to wrangle into a highly performant and efficient competing model than people think. The subset of people who can do so well are concentrated inside companies like OpenAI. For the majority of customers, the simplicity of working with and on top of OpenAI, knowing that it is best-in-class with a powerful platform and ecosystem built around it, will be the easy choice.

If this is the case, not only is Thrive’s investment in OpenAI a clear compounding winner on the path to a $1-5T market cap, it means the majority of VC investments in the space are completely barking up the wrong tree.5 Peter Thiel loves to say that the most obvious, but correct bet in growth tech was just investing in FAANG over the past decade. Many people missed it because it seemed too stupid. What if the most obvious, but correct bet in AI right now is just investing in OpenAI and the ecosystem built around it?6

Paul Graham wrote fourteen years ago that Sam Altman was one of the most interesting five startup founders of the past 30 years when he was twenty-four years old and hadn’t accomplished anything. Amazingly, he writes the following:

Honestly, Sam is, along with Steve Jobs, the founder I refer to most when I'm advising startups. On questions of design, I ask "What would Steve do?" but on questions of strategy or ambition I ask "What would Sama do?"

What I learned from meeting Sama is that the doctrine of the elect applies to startups. It applies way less than most people think: startup investing does not consist of trying to pick winners the way you might in a horse race. But there are a few people with such force of will that they're going to get whatever they want.-Paul Graham

Do you want to be competing against that? Perhaps a lot of VCs simply don’t realize what they’re up against.

Thrive is betting that you don’t want to compete against Sam Altman. Quality will compound on itself and the startup that created the category will define it. Contrary to many other VCs, they’re not going to invest in Third Avenue or the infrastructure around it thinking that it’s going to become Fifth Avenue.

They’re just going to invest in Fifth Avenue.

They might just be right.

I have to admit, I’m not completely sold on this premise and want to spend the next few weeks or months thinking about it. The opening line to this article literally popped into my head when I woke up in the middle of the night last Friday and I then spent the weekend noodling on it casually. I’d love to hear any strong thoughts or feedback in either direction if you have it: feel free to email me pratyush [at] susaventures [dot] com

The analogy to cloud is used often here: there were 3 major cloud providers, AI will have a similar breakdown.

You could argue it’s a secretly pessimistic take to believe that the future of foundation models is commoditizable. Essentially, that’s a belief the great leaps have already been done and we won’t see much more than incremental improvement in the technology.

Credit to John Luttig’s piece “Hallucinations in AI” for surfacing these stats.

Not all of these need to be true for the Thrive thesis to play out. Eg: domain expert models may be created long-term that outperform OpenAI in some use cases, but the majority still gets routed through OpenAI.

There’s an interesting element where, unlike Thrive, most VCs are not well-structured or able to invest in OpenAI. You could argue that they almost need an alternative ecosystem to be built so that they can take part meaningfully in the trend. This is a cousin of the ‘revenge VC narrative’ framework.